Have you ever sat with your silver coins in your hand, wondering if they have any value? If you want to sell silver coins, there’s a chance they might have worth beyond their face value. But, how do you know? Read on to find out.

In the U.S., silver coins have been circulated and accepted as currency since the Colonial era. A variety of coins could be found in those days, some of domestic origin, others from overseas.

However, many of those silver coins are informally called “junk silver.” Those coins have no value as collectibles, but that does not mean that junk silver coins are worthless — they are worth only face value or melt value.

If you have silver coins to sell, we can offer you a free professional appraisal and highly competitive offer. Fill out this form to request your complimentary, fully insured Appraisal Kit:

What Silver Coins are Worth

As a seller, you want to receive the maximum payout for your coins based on the silver value and the demand for that particular coin’s condition, scarcity, and grade.

With that said, silver coins can vary widely in value. At minimum, any silver coin is worth its “melt value”—that is, the content of its silver in the marketplace at any given time. But there are other factors that can substantially increase the value of a particular coin.

So, without being a professional coin collector, how can you determine the value of your silver coins?

Factors that Determine the Value of Your Silver Coins

Important factors that determine the value of your silver coins include:

Amount of silver – The greater the silver content relative to other metals, the higher the coin’s value.

Mintage number – The number of coins struck by the mint, though it may not reflect the number of surviving coins.

Number of existing coins – This is the number of coins that survive. Due to the historical tendency to melt down silver coins for their bullion value, some coin issues are rarer than their mintage number suggests.

Rare characteristics – “Error coins,” created by a mint production mistake, frequently command far higher prices.

Condition – What is the current physical condition of the coin? (Avoid cleaning old collectable coins, as it can decrease their market value.)

Demand – The number of collectors interested in the coins can impact their market price.

Grade – Coin grading is the process of determining the condition of a coin, and it’s a standardized method for both amateur and professional coin collectors. You can utilize grading scales, such as The American Numismatic Association’s (ANA), to research and compare your coin’s characteristics, flaws, and condition.

Premium – Premium coins are those that have a value beyond their silver content, like the Morgan and Peace silver dollars.

Identify Where Coins Were Minted

The mintage of a coin can definitely affect its value. Some coins are in higher demand and are rarer than others because smaller amounts of these coins were minted during certain years.

Nearly every coin will have a mint mark, which indicates the location of the mint that produced it. A total of six mints were responsible for the production of all U.S. coins:

- Carson City – CC (no longer operational)

- Denver – D

- New Orleans – O (no longer operational)

- Philadelphia – P

- San Francisco – S

- West Point – W

If you’re uncertain whether you have a valuable collectible or merely “junk” silver, seek the services of a professional appraiser or coin dealer. You can ship your coins to us, and our certified appraisers will evaluate the coins for free and make you an offer.

US Coins Containing Silver

The design and composition of various denominations of silver coins have changed over the years. Whether they are still being produced or have been relegated to history, these precious metal coins have long been popular among both investors and collectors.

Here is a brief timeline of U.S. silver coins over the years:

- 1792: The United States Mint first begins producing coins.1

- 1794: The very first silver coin, the Flowing Hair silver dollar, is introduced.3

- Until 1964: The composition of all silver half dollars, quarters and dimes is 90% silver.

- 1965: As the price of silver increases, new, more cost-effective compositions are introduced. Dimes and quarters are made only from copper and nickel, and half dollars become only 40% silver.2

- 1971: The Kennedy half dollar is switched to the same copper and nickel alloy as dimes and quarters.2

- 1976: Few 40% silver collectible coins (quarters, half dollars and Eisenhower dollars) are minted for the U.S. bicentennial.4

- 1977: The U.S. Mint ceases production of silver coins.5

- 1986: Silver is reintroduced in the form of the American Silver Eagle.6 This new, 99.9% pure silver coin is made in both bullion and collectible proof versions, giving it value in multiple markets. This coin is still in production today.

- 1992: The U.S. Mint briefly produces a limited number of 90% silver proof sets for Kennedy half dollars,7 Roosevelt dimes8 and Washington quarters.9

The following is an extensive list of U.S. silver coins you can sell, including years run, Actual Silver Weight (ASW) and other information.

Flowing Hair Half Dimes (1794-1795)

- ASW of 0.03834 troy ounces (1.1926 grams)

- One of the first coins ever produced by the U.S. mint

Flowing Hair Half Dollars (1794-1795)

- ASW of 0.38572 troy ounces (11.99 grams)

- Desirable among collectors

Flowing Hair Dollars (1794-1795)

- ASW of 0.77144 troy ounces (23.99 grams)

- The first U.S. silver dollar ever minted, it’s extremely desirable to collectors

Bust Dollars (1795-1804)

- ASW of 0.77144 troy ounces (23.99 grams)

Bust Half Dimes (1796-1837)

- ASW of 0.03863 troy ounces (1.2015 grams)

- Composed of roughly 89% silver

Bust Dimes (1796-1837)

- ASW of 0.07726 troy ounces (2.4 grams)

- A smaller version containing the same amount of silver was introduced in 1828

Bust Half Dollars (1796-1839)

- ASW of 0.38572 troy ounces (11.99 grams)

- The “Capped Bust” design was the first to consistently show the 50 cent face value

Draped Bust Quarters (1796-1838)

- ASW of 0.19286 troy ounces (5.99 grams)

- The first quarter ever minted in the U.S.

Seated Liberty Half Dimes (1837-1873)

- ASW of 0.03877 troy ounces (1.206 grams)

- The Seated Liberty is one of the longest running coin designs, with multiple variations across different denominations

Seated Liberty Dimes (1837-1891)

- ASW of 0.07726 troy ounces (2.4 grams)

Seated Liberty Quarters (1838-1891)

- ASW of 0.1933 troy ounces (6 grams)

Seated Liberty Half Dollars (1839-1891)

- ASW of 0.38658 troy ounces (12.024 grams)

Seated Liberty Dollars (1840-1873)

- ASW of 0.77345 troy ounces (24.057 grams)

Three Cent Silvers (1851-1873)

- ASW of 0.0193 troy ounces (0.6 grams) from 1851 to 1853

- ASW of 0.0217 troy ounces (0.675 grams) from 1854 to 1873

- Commonly called “trimes”

Trade Dollars (1873-1885)

- ASW of 0.78763 troy ounces (24.498 grams)

- Named for the fact that the coin was made specifically to meet export demands

Twenty Cents (1875-1878)

- ASW of 0.14468 troy ounces (4.5 grams)

- Unpopular and easily confused with the quarter, it did not last long

Morgan Silver Dollars (1878-1921)

- ASW of 0.77344 troy ounces (24.06 grams)

- Named for George Morgan, the coin’s designer

Barber Half Dollars (1892-1915)

- ASW of 0.3617 troy ounces (11.25 grams)

- All denominations of Barber coins are named for their designer, Charles Barber

Barber Dimes (1892-1916)

- ASW of 0.07234 troy ounces (2.25 grams)

Barber Quarters (1892-1916)

- ASW of 0.18085 troy ounces (5.625 grams)

Commemorative Quarters, Half Dollars and Silver Dollars (1892-Present)

- ASW varies depending on the coin, but can often be estimated based on other coins of equal face value

- May commemorate a president, historical figure, event or other concept

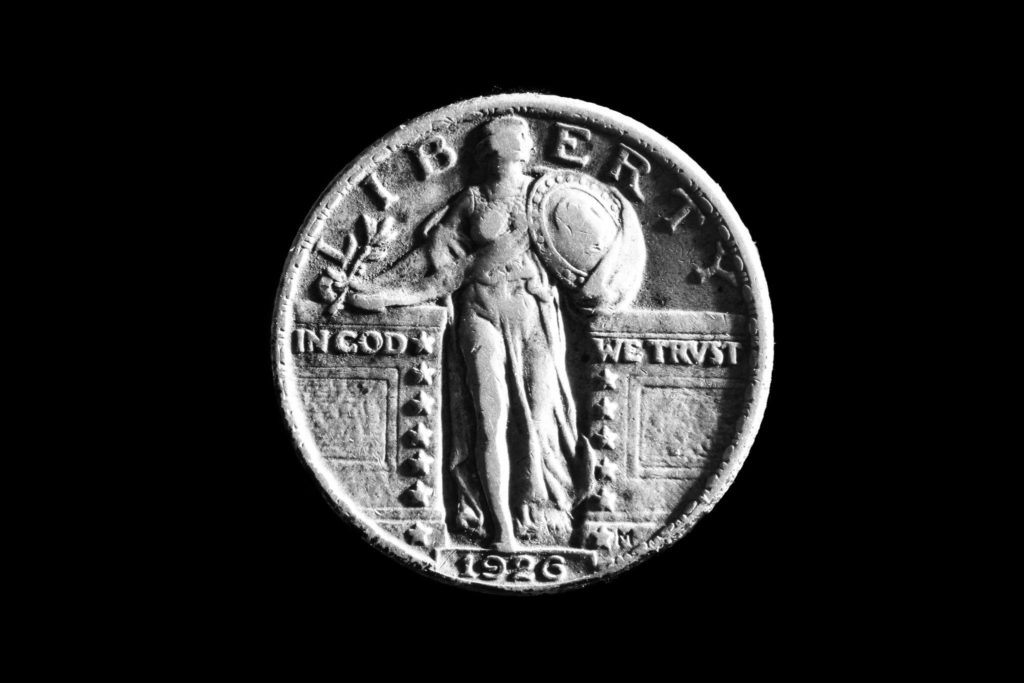

Standing Liberty Quarters (1916-1930)

- ASW of 0.18085 troy ounces (5.625 grams)

- Modified slightly in 1917 to cover an exposed breast present in the original design

Mercury Dimes (1916-1945)

- ASW of 0.07234 troy ounces (2.25 grams)

- Officially called “Winged Liberty” and nicknamed for its similarity to the Roman god Mercury

Walking Liberty Half Dollars (1916-1947)

- ASW of 0.3617 troy ounces (11.25 grams)

Peace Dollars (1921-1935)

- ASW of 0.77344 troy ounces (24.06 grams)

- Designed in part to commemorate the end of the first world war

Washington Quarters (1932-1964)

- ASW of 0.18085 troy ounces (5.625 grams)

- Initially designed as a limited run commemorative coin

Wartime Jefferson Nickels (1942-1945)

- ASW of 0.05626 troy ounces (1.75 grams)

- Minted during World War II using 35% silver

- Can also be identified by a letter marked on the reverse (P, D or S)

Roosevelt Dimes (1946-1964)

- ASW of 0.07234 troy ounces (2.25 grams)

- Commemorates the life and presidency of Franklin D. Roosevelt

Franklin Half Dollars (1948-1963)

- ASW of 0.3617 troy ounces (11.25 grams)

- One of the only coins to feature a non-presidential figure

Kennedy Half Dollars (1964-1970)

- ASW of 0.3617 troy ounces (11.25 grams) in 1964

- ASW of 0.14789 troy ounces (4.6 grams) from 1965-1970

- The 1964 version was 90% silver

Eisenhower Dollars (1971-1978)

- ASW of 0.3161 troy ounces (9.83 grams)

- Not all Eisenhower Dollars are 40% silver; those that are have an “S” mintmark

American Silver Eagles (1986-Present)

- ASW of 1 troy ounce (31.1 grams)

- The only coin that is almost exclusively made of silver (99.9%)

Popular Silver Coins

United States dime, quarter, half dollar and dollar coins minted in 1964 and earlier are 90% silver, making them desirable coins for their silver content. Examples of these silver coins that frequently sell for the value of their precious metals include:

- Mercury silver dime (1916-1945)

- Roosevelt silver dime (1946-1964)

- Washington silver quarter (1932 & 1934-1964)

- Walking Liberty half dollar (1916-1947)

- Franklin half dollar (1948-1963)

- Kennedy half dollar (1964)

The United States’ official silver bullion coin—the Silver Eagle (1986-current)—is a highly desired coin as well, at 99.93% silver content.

Some silver coins do have substantial value as collectibles, due to their historical importance or other unusual characteristics. What follows is a quick look at some of the more well-known silver coins that are traded on the collector’s market.

Seated Liberty Half Dollar

Issued from 1839 to 1881, the Seated Liberty half dollar is a perennial favorite among silver coin collectors. The obverse of the coin, designed by noted engraver Christian Gobrecht (1785-1844), features the Goddess of Liberty seated upon a rock. This design also appeared on other coins issued by the U.S. Mint during the middle years of the 19th century, including the half dime, the dime, the quarter, and the silver dollar.

Various modifications were made to this basic design over the years, such as the addition of arrows and rays on the reverse (beginning in 1853) and the inclusion of the motto “In God We Trust” (beginning in 1866).

Many Seated Liberty half dollars can be purchased for under $100, but certain rare varieties can sell for substantially more. The most valuable of these silver half dollars is the so-called “1853-O Without Arrows.” Only four are known to exist. In 2012, one of these rare silver coins sold for $218,000 at auction.

Capped Bust Half Dollar

The Capped Bust half dollar was made from 1807 to 1839. Its obverse design, created by German immigrant John Reich, shows a side profile view of Lady Liberty, wearing a Phrygian cap. The Capped Bust design was quite popular and it was shared by the dime (beginning in 1809), the half dime (from 1829), and the quarter (from 1815) during this era.

In 1836, the Capped Bust half dollar underwent a slight reduction in weight and size. It also acquired a reeded edge. Capped Bust coins of both varieties are in high demand among collectors.

Flowing Hair Dollar

The Flowing Hair dollar was the very first dollar coin produced by the U.S. government, and as you might expect, it is quite valuable these days. Designed by Robert Scot (1745-1823), who served as Chief Engraver of the United States Mint, it features a bust of Lady Liberty on the obverse and an eagle on the reverse.

This rare coin was produced for only a brief span of time: The first ones were minted in 1794 and the last ones in 1795 (when the vast majority were made). Relatively few of these coins have survived to the present day. Out of the 1,758 Flowing Hair coins created in 1794, only about 140 are still around.

American Silver Eagle

First released in 1986, the beautifully designed American Silver Eagle is the only silver bullion coin currently issued by the United States Mint. Its obverse design is a modification of the Walking Liberty half dollar (1916-1947), which features a full-length depiction of Lady Liberty in mid stride, carrying oak and laurel branches. Although it has a face value of $1, it is worth more than the spot price of its silver—sometimes far more.

Unlike the other collectible coins we have mentioned in this section, American Silver Eagles are quite common. Literally hundreds of millions have been produced since the first ones appeared in ’86. If you want to get into coin collecting, Silver Eagles are a good way to start, as it’s easy to find them at a reasonable price.

Quite a few coin collectors make it their mission to get a Silver Eagle from every year. 1996 Silver Eagles are especially sought after due to their relative scarcity. Only 3.6 million were made in ‘96 (as compared with over 30 million for some years).

How to Sell Silver Coins

When you decide to sell silver coins, you have two main options: Sell your silver coins locally or sell silver coins online.

How to Sell Silver Coins “Near Me”

To find where to sell silver coins “near me,” go to your favorite search engine and enter search terms like “places that buy silver coins,” “buyer of silver coins,” or “best place to sell silver coins near me.”

After looking at the places that buy silver coins in your area, decide if you want to go drive around town to visit the promising ones. If you choose to sell locally, here is a 7-step formula about how to sell silver coins:

- Organize and sort your silver coins. Separate the coins by type, year, and mint mark. Having your collection well organized will make the selling process smoother.

- Determine the value of your coins. Research the current spot price of silver and calculate the melt value of your coins based on their silver content. Rare dates, mint marks, and high-grade coins can be worth significantly more than just melt value.

- Decide what to sell. You can sell your entire collection at once or hold back any coins with extra collectible value to sell separately. Consider your financial goals and the current silver market when deciding how much to sell.

- Get your coins appraised. Before selling, it’s wise to get your collection appraised by a knowledgeable coin dealer or professional grading service. They can help identify any particularly valuable coins and give you a realistic idea of what your collection is worth.

- Compare offers. Contact multiple potential buyers to get quotes for your coins. Consider factors like reputation, professionalism, and offered prices. Don’t feel pressured to take the first offer you receive.

- Negotiate the best deal. Once you have offers, negotiate for the best price for your coins. Stress any key selling points like rare dates/mints or exceptional conditions. Be willing to walk away if you aren’t satisfied with the offer.

- Finalize the sale. Once you agree on a price, complete any required paperwork and arrange for secure payment and delivery/pickup of your coins. Request a detailed receipt for your records.

There’s a lot involved when you set out to “sell silver coins near me.” Local is not always your best option because those stores have overhead that online buyers do not. Plus, if they want to resell the coins, then they will have to shave some off what they will offer you so they can make a decent profit. So, when you compare offers, make sure you include online buyers of silver coins, like Cash for Gold USA.

How to Sell Silver Coins Online to Cash for Gold USA

Like trying to find a local buyer of silver coins, you can look for online buyers of silver coins by searching “sell coins online for cash” or “sell silver coins online.”

When you find a reputable, trustworthy online silver coin buyer, you will likely follow these three steps to sell silver coins online:

- Request a free Appraisal Kit.

- Send your valuables in (no need to sort or clean).

- Accept or reject the offer.

The process should be that simple.

Where to Sell Silver Coins

Understandably, anyone will want to sell silver coins if they are valuable. When you do, you will want to sell them to the most trusted and experienced buyer.

The good news is that you have multiple options when it comes to selling your silver coins. The bad news is that not all of these options are equally appealing.

Local Coin Dealers, Pawn Shops, or Jewelry Stores

One convenient way to sell your old silver coins is to visit a local pawn shop or jewelry shop, as these types of businesses are usually interested in buying valuables of this nature. Unfortunately, these establishments do not offer you anywhere near the true market value of your coins.

There are several reasons why this happens, the primary one being the need to offset all the expenses that go along with running a brick-and-mortar store, such as rent, utilities, insurance, and security. Unless a business specializes in coins, the offers are often insufficient.

Another issue arises when your silver coins are in poor condition. Many dealers will refuse to make an offer on damaged or otherwise defective coins.

Sell Silver Coins Online

What can you do to improve your chances of getting a fair offer for your silver coins? The internet provides an alternative that you shouldn’t overlook.

Working with an online buyer like Cash For Gold USA increases your chances of getting the payout you deserve, with only minimal effort on your part. Benefits of selling silver coins online include:

- Bigger payouts – Online buyers have fewer business expenses, which means they can afford to offer more money without cutting into their bottom line.

- Free, up-to-date appraisals – While pawn shops often have outdated market data, online buyers who specialize in these valuable metals are more likely to have accurate information.

- Fast cash – An online coin buyer will often provide an offer within 24 hours of receiving your silver coins.

- Expanded selection of dealers – If you want to sell your silver coins to a brick-and-mortar store, you’re pretty much limited to your immediate geographic area. By contrast, online buyers can come from practically anywhere.

- Expanded selling options – Online dealers are often willing to accept the kinds of coins—such as those with severe damage—that jewelry shops commonly reject.

- Convenient process – When you sell your coins to an online buyer, you don’t have to spend hours in traffic—you can conduct the entire transaction from the comfort of your home and never leave the house.

Cash For Gold USA is the ideal buyer for your old silver coins. To date, we have served thousands of customers and paid out millions of dollars. We also handle gold, platinum, and palladium valuables.

Sources:

1. The United States Mint – Timeline of the United States Mint, https://www.usmint.gov/learn/history/timeline-of-the-united-states-mint. Retrieved Jan. 12, 2024

2. Wikipedia – Silver as an investment, https://en.wikipedia.org/wiki/Silver_as_an_investment. Retrieved Jan. 12, 2024

3. Wikipedia – Flowing Hair dollar, https://en.wikipedia.org/wiki/Flowing_Hair_dollar. Retrieved Jan. 12, 2024

4. Wikipedia – United States Bicentennial coinage, https://en.wikipedia.org/wiki/United_States_Bicentennial_coinage. Retrieved Jan. 12, 2024

5. The United States Mint – One Hundred Years of Silver Dollar Coinage (1878-1978), https://www.usmint.gov/news/inside-the-mint/one-hundred-years-of-silver-dollar-coinage-1878-1978. Retrieved Jan. 12, 2024

6. Wikipedia – American Silver Eagle, https://en.wikipedia.org/wiki/American_Silver_Eagle. Retrieved Jan. 12, 2024

7. Wikipedia – Kennedy half dollar, https://en.wikipedia.org/wiki/Kennedy_half_dollar. Retrieved Jan. 12, 2024

8. Wikipedia – Roosevelt dime, https://en.wikipedia.org/wiki/Roosevelt_dime. Retrieved Jan. 12, 2024

9. Wikipedia – Washington quarter, https://en.wikipedia.org/wiki/Washington_quarter. Retrieved Jan. 12, 2024

10. Coin World – Market Analysis: 1853-O Seated Liberty half dollar, https://www.coinworld.com/news/us-coins/market-analysis-1853-o-seated-liberty-half-dollar. Retrieved Jan. 12, 2024

11. PCGS – 50C 1839 REEDED EDGE. SMALL LETTERS. PCGS VF25, https://www.pcgs.com/auctionprices/item/1839-50c-capped-bust-small-letters/6180/-4218411448714266687. Retrieved Jan. 12, 2024

12. GreatCollections – America’s First Silver Dollar Acquired for $12 Million by GreatCollections, https://www.greatcollections.com/kb/Americas-First-Silver-Dollar-Acquired-for-12-Million-by-GreatCollections-t447-4.html. Retrieved Jan. 12, 2024

13. American Numismatic Association – Do You Have Key Date American Silver Eagles?, https://www.money.org/do-you-have-key-date-american-silver-eagles/. Retrieved Jan. 12, 2024

About Cash For Gold USA

Cash for Gold USA is a prominent online buyer of gold, gold coins, silver, diamonds, platinum, and palladium in the United States. Since 2005, we have paid millions to thousands of customers for their unwanted or broken precious metal jewelry. We offer a quick and straightforward selling process, ensuring customers receive prompt and competitive offers for their items. Learn more about us and what our customers say about Cash for Gold USA, or request your free Appraisal Kit now: